Milk, Dairy and Grain Market Commentary

- Sarina Sharp

- Dec 12, 2025

- 4 min read

By Sarina Sharp, Daily Dairy Report

Winter weather is making life on the farm a little harder in the Midwest, but a growing portion of the herd is now shielded from the elements in state-of-the-art housing. Meanwhile, pleasant conditions prevail in southern dairy areas, where cattle are comfortable in open lots. By all accounts, dairy parlors across the nation are full and so are milk tanks. Strong components ensure that dairy processors can run at full throttle.

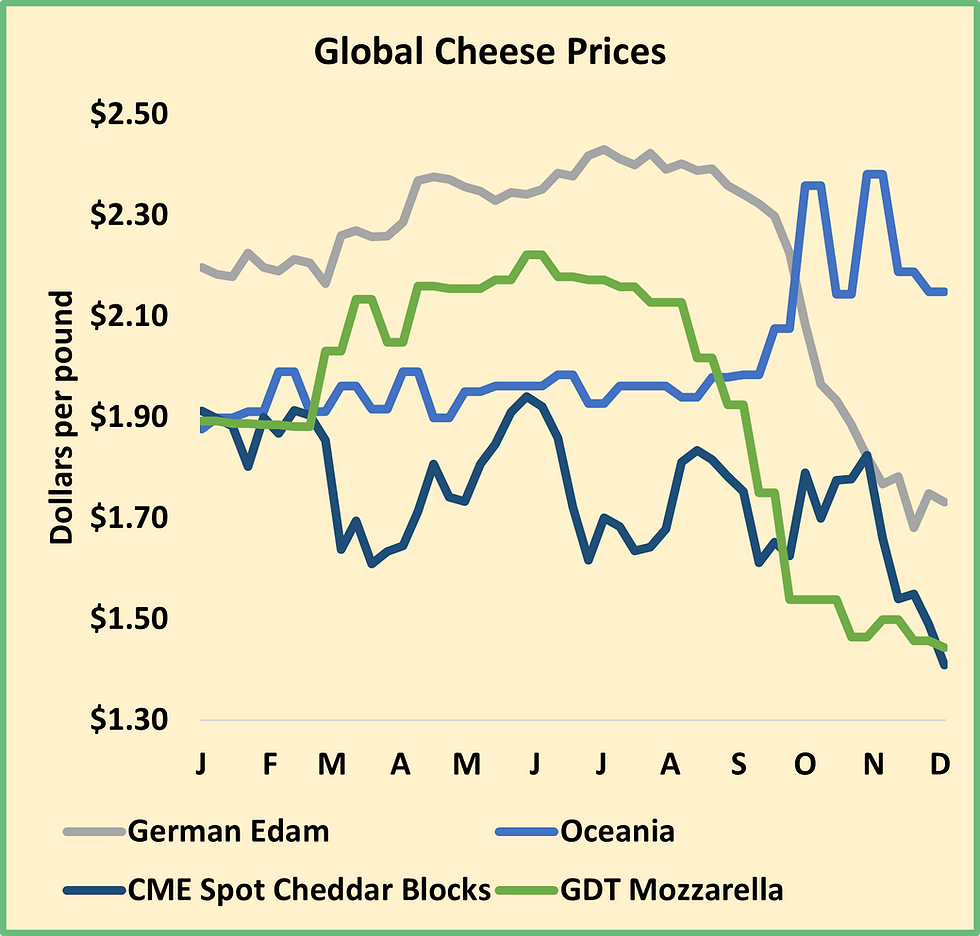

Milk is similarly abundant in the rest of the world, with staggering volumes in Europe, robust collections in New Zealand, and an unexpected recovery in Chinese milk production. International dairy product prices continue to drop. For now, U.S. dairy is the cheapest, but the gap is narrowing. Global dairy product prices are in a race to the bottom.

The U.S. stood alone in the bargain basement this summer, and it attracted opportunistic buyers. Sales booked midyear shipped in the fall, and September was another strong month for cheese, butter, and whey powder exports. The U.S. sent 116.5 million pounds of cheese abroad in September, 34.5% more than in September 2024. Daily average shipments were the highest ever, and exports to Mexico were the second-largest on record. Sales to key markets like Japan and South Korea remained strong, and Australia climbed the ranks to become the third-largest foreign market for U.S. cheese. Australia has already imported more U.S. cheese in 2025 than in any other year, and there are three months of cargoes left to count.

U.S. butter and milkfat exports fell short of July and August volumes, but they were still historically large. Total milkfat exports were twice as great as September 2024, while butter exports were 2.7 times larger than they were a year ago. Imports remained depressed, and even Ireland failed to send much butter to the U.S. Hopefully Cosco found some American butter to stock shelves that used to proffer Kerrygold.

U.S. whey powder exports reached their highest level since March 2023. Shipments outpaced the prior year by 8.3% thanks to strong sales to Mexico, China, and Vietnam. But U.S. exports of whey protein concentrates (WPC) fell as manufacturers prioritized sales to domestic customers.

Meanwhile, U.S. nonfat dry milk (NDM) exports slumped to an eight-month low, down 18.5% year over year. Sales to Mexico dropped 17.3% compared to September 2024, a decline that was large enough to make overall U.S. dairy exports to Mexico fall below September 2024 levels. Total dairy exports to other top markets, including Canada and China, also fell short of prior-year volumes.

In a world flush with milk, competition for market share is getting fiercer by the day. The U.S. has struggled to gain traction on milk powder sales, and it may lose ground for cheese, butter, and whey powder if the price is not right. It’s possible that first-quarter cheese sales will disappoint after the October rally pushed importers to look elsewhere. Indeed, given the scale of U.S. cheese output, anything short of the recent record-setting volumes is likely to feel inadequate. And there is always the risk that today’s big sales will result in slower demand down the road if importers are taking advantage of the selloff to stock up.

U.S. dairy product prices must remain low enough to keep cargoes moving overseas. But they don’t need to decline day after day. This week, many of the product markets stabilized, and Class III futures bounced back. CME spot butter regained a quarter-cent and closed at $1.48 per pound. Spot whey powder climbed 2ȼ to 76.5ȼ. Spot NDM dropped a penny to $1.16 smack in the middle of the recent trading range. But Cheddar blocks slipped 3.5ȼ to $1.345, their lowest price since July 2023.

The spot market setback weighed on December Class III futures. They fell 12ȼ this week to $15.90 per cwt. But 2026 Class III futures rebounded. The trade believes that prices have fallen far enough for now. Hopefully, $15 milk is enough to boost demand.

Nearby Class IV futures held steady this week. But deferred contracts continued to lose ground. December through February Class IV hovers in the mid-$13s, a price that inspires a “Bah! Humbug” and no Christmas cheer. The market forecasts Class IV milk at $14 or higher beginning in March.

Grain Markets

The soy complex is growing more skeptical of the Trump administration’s promises that China will buy U.S. soybeans. Indeed, administration officials now suggest that China will buy 12 million metric tons of U.S. soybeans – about half of their typical annual total – by the end of the 2025-26 crop year next August rather than by January. USDA made no changes to its soybean export forecast in its monthly update to supply and demand estimates on Tuesday, but other data point downward. U.S. commitments to export soybeans through early November were 40% lower than the prior year, and September through November shipments lagged 2024 volumes by 45%.

In contrast, the U.S. is sending corn abroad at a record-shattering pace. First-quarter shipments surpassed the prior record set in September through November 2007. Through early November, U.S. commitments to ship additional corn were 28% above last year’s pace, and full-season exports notched a new all-time high in the 2024-25 crop year. In Tuesday’s update, USDA raised its forecast for corn exports to 3.2 billion bushels, up 12% from last year’s record high. The higher export figure reduced the projection for end-of-season corn stocks to 2.03 billion bushels. But that is still 32% greater than last season and the highest ending stocks figure in seven years. The trade is trying to find a price that acknowledges both booming exports and abundant corn. This week March corn settled at $4.405 per bushel. That was down almost a nickel from last Friday’s close, but it is still at the high end of the recent trading range. Meanwhile, soybean prices fell significantly, and January soybean meal closed at $302 per ton, down $5.40 on the week.

Comments