Milk, Dairy and Grain Market Commentary

- Oct 24, 2025

- 4 min read

By Monica Ganley, Quarterra

Milk & Dairy Markets

Dairy markets both in the U.S. and across the globe continue to feel out the balance of supply and demand. Although the dramatic price decreases seen during the last few weeks have given way to more modest movements, the overall market tone remains bearish. Tuesday’s Global Dairy Trade (GDT) auction, albeit glitchy, ultimately saw the GDT Price Index move down 1.4%, the fifth consecutive lower result. The decline in the index reflected lower prices across every product except anhydrous milkfat.

Plentiful milk supplies are the key factor weighing on international dairy prices as volumes across the major suppliers continue to charge upward. Volumes are soaring in the Southern Hemisphere as the region traverses its seasonal peak. Producers in New Zealand saw September production grow by 2.5% and 3.4% on a fluid and solids basis, respectively, further adding to an already robust season. Meanwhile, Argentina posted a 9.9% increase in fluid terms while Uruguayan volumes rose 3.2% in liquid terms and 5% on a solids basis.

Though data is scarce, and seasonal trends are inverted, the Northern Hemisphere is also seeing important production gains relative to last year. European production continues to exceed expectations with volumes in the European Union and the UK up 3.3% in August. Meanwhile in the U.S., even though the government shutdown prevented the publication of the Milk Production report this week which would have shown September data, all signs point to continued production strength.

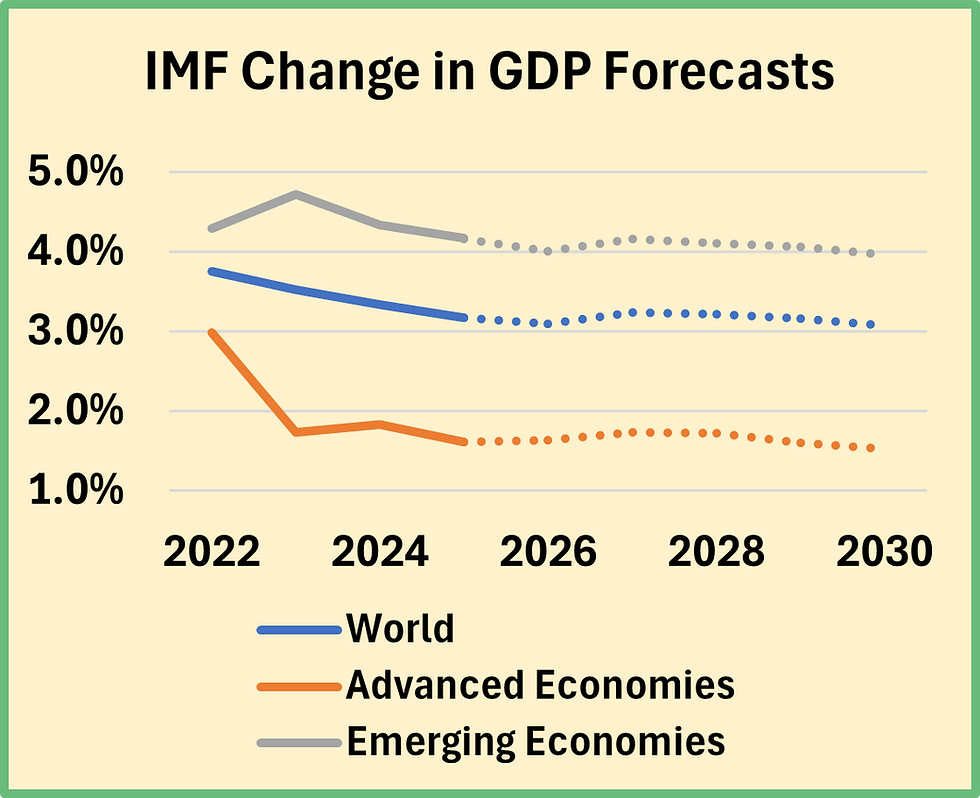

While supply is undeniably strong, the story of demand is less clear. Global dairy trade has started to perk up in recent months, and lower prices could help to encourage further movement of dairy products. The International Monetary Fund recently upgraded its expectations for global GDP growth, forecasting the global economy to expand by 3.2% in 2025, up 0.1 percentage points from the prior review in July. Stronger-than-expected economic performance bodes well for dairy demand and dairy trade.

However, demand from China, the largest global dairy importer, remains subdued. Imports of WMP were up a dramatic 41.2% year over year in September, but cumulative volumes remain very weak by historical standards. Meanwhile imports of SMP slumped by 12.5%. Chinese imports of low protein whey products fell by a more modest 3.1%. Products targeted toward consumers fared better with cheese imports rising 13.5% versus September 2024 while butter volumes soared 64.7% year over year. Chinese milk production continues to buckle under the burden of low milk prices. Even so, demand remains weak and Chinese manufactured WMP has been showing up in international arenas, suggesting the country has volume to spare.

Back in the U.S., consumers are also facing demand pressures. September inflation data showed that prices were up 0.3% from August and 3.0% higher than a year ago. While this marks the strongest year over year increase seen since January, the uptick was nevertheless lower than what many economists had forecast. Over the past year menu prices have risen by 3.7% while the increase in grocery prices has trailed headline inflation at 2.7%. This dynamic is likely to continue encouraging consumers to have more meals at home rather than out at restaurants – a shift which will almost certainly be reflected in dairy demand.

Cheese is one of the key products likely to be affected by this change as consumers tend to eat cheese in different formats at retail compared to through foodservice. While domestic demand undergoes this transformation, international interest has weakened as U.S. cheese prices have lost their competitive edge compared to other suppliers. Even so, the CME Cheddar Block spot market found enough traction to move up by a quarter cent this week, ending Friday’s session at $1.7775/lb. It was an upbeat week at the exchange with 32 loads of product trading hands.

But cheese wasn’t the only product to make an upward move as butter also found its footing late in the week. After sliding as low as $1.545/lb. on Wednesday, increases on Thursday and Friday brought the CME spot butter price back into the $1.60s. Friday’s session ended with butter at $1.6025/lb., up 0.75¢ from last week as 66 loads moved. Cream remains abundant and butter churns are busy. Domestic demand is steady as buyers wrap up their holiday preparations. Meanwhile, international demand remains upbeat, especially for butter with 82% fat.

After several weeks with subdued activity, there was also some action in the nonfat dry milk market this week as the spot price rose a nickel to $1.16/lb. A total of 38 loads of product traded during the week including 28 on Friday alone. Meanwhile, the dry whey market continued its upward campaign adding 3.5¢ to end the week at 69¢ per pound with three loads moving. Demand for high protein whey products remains insatiable, leaving limited raw whey available to be manufactured into dry whey.

Grain Markets

As the U.S. harvest season nears its conclusion, the prolonged government shutdown has clouded the outlook on U.S. yields and production volumes. Yet, despite the lack of information, markets found enough reason to move upward over most of the week. DEC25 corn settled at $4.28/bu. on Thursday, up 5.5¢ from last Friday. The soy complex made an even more dramatic upward move as JAN26 soybeans added just over 33¢ to settle on Friday at $10.62/bu. Low feed prices have played a critical role in maintaining producer profitability, especially as milk prices have moved lower. While feed prices remain modest by historical standards, further upward movements could begin to eat into margins.

Comments