Milk, Dairy and Grain Market Commentary

- Oct 10, 2025

- 4 min read

By Monica Ganley, Quarterra

Milk & Dairy Markets

As the government shutdown stretches into its second week, the dairy industry continues to operate without access to key data. To this point, the main information gaps for the dairy sector include numbers for trade and dairy product output. However, if the shutdown persists, upcoming reports on milk production and inventories will also be missed, further obfuscating stakeholders’ understanding of market drivers.

But even though data was scarce, that doesn’t mean that the markets were dull. Dairy markets, both in the U.S. and around the world continue to lean bearish as they digest the status of supply and demand. Milk production remains hefty the world over. Volumes in the European Union and the U.K. were up 3.3% in August as strong milk prices and favorable weather supported production. While animal health issues remain present, they have so far not derailed growth. European gains come on top of upbeat production in the U.S., New Zealand, and South America, further contributing to a world that is awash in milk.

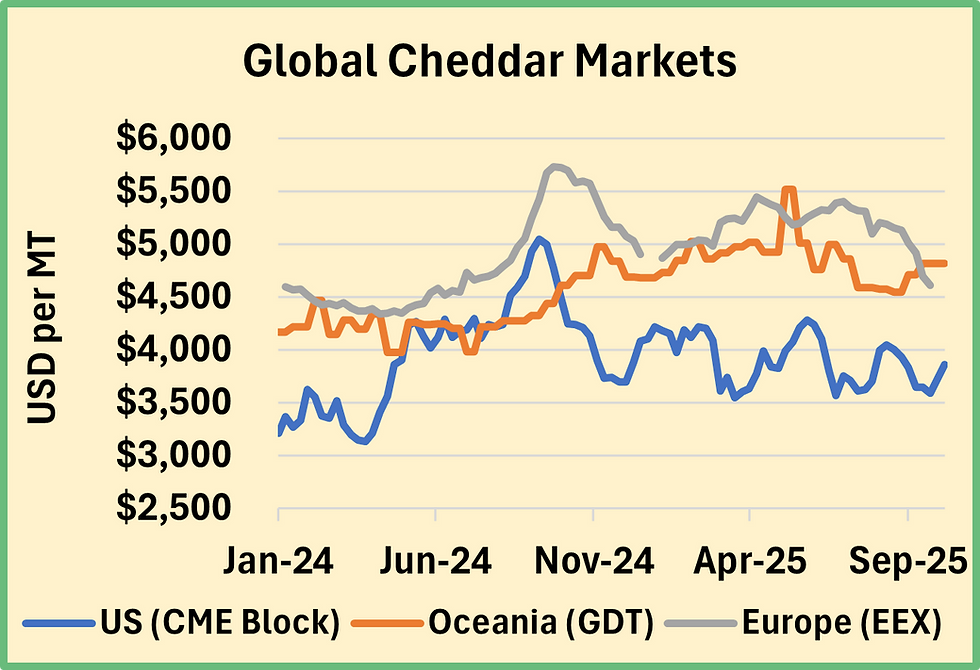

The global appetite for dairy products is stable to slightly stronger, but current demand is no match for the onslaught of supply. Dairy markets continue to buckle under the pressure of current milk volumes with prices for most commodities moving downward. In recent weeks we witnessed dramatic downward price movements in the U.S. and Europe. This week the Global Dairy Trade (GDT) auction was added to that list as the GDT Price Index fell 1.6% with lower prices seen across nearly every product except Cheddar and anhydrous milk fat. However, no product saw losses as large as mozzarella which plummeted 11.8%.

Dramatically lower prices in Oceania and Europe have brought convergence to the cheese markets. The U.S. has enjoyed an important price advantage for its cheese throughout this year which has played a key role in boosting exports. However, this competitive edge is rapidly disappearing, and U.S. prices may need to move lower in order for new deals to be inked that will keep product moving offshore.

The CME cheese markets gave into this pressure moving downward over the week. The block Cheddar price decreased by 9¢, ending today’s session at $1.70/lb. Barrels also moved lower, wrapping up the week at $1.71/lb., down 6¢ compared to last Friday. It was a somewhat active week for blocks with 18 loads trading hands while activity in the barrel markets remains subdued as no trades were made.

Reports indicate that several important cheese facilities, especially in the Western U.S., have endured disruptions to production. This hiccup in output has caused headaches for milk haulers and may be lending a bit of support to the market as buyers scramble to compensate for lost volumes. Nevertheless, overall demand remains flat with weaker foodservice demand continuing to cause anxiety for the sector.

After a brief respite the butter market resumed its downward slide this week. The market continues to respect the $1.60 threshold which it has not yet broken, although it has come awfully close. The market slid as low as $1.6025/lb. on Thursday before staging a slight rebound on Friday. Ultimately the market closed at $1.605/lb., down 14.5¢ from last week as 47 loads traded hands.

If milk production is long, cream is longer as the fat content of raw milk continues to rise. Cream multiples remain weak, and butter churns are well supplied. With all evidence pointing to an abundance of milkfat, the incentive to produce milkfat at the farm is dissipating. Some producers are considering reformulating feed rations to reduce the emphasis on fat production but with component gains baked into genetic improvements, fat supplies are likely to be plentiful for the foreseeable future.

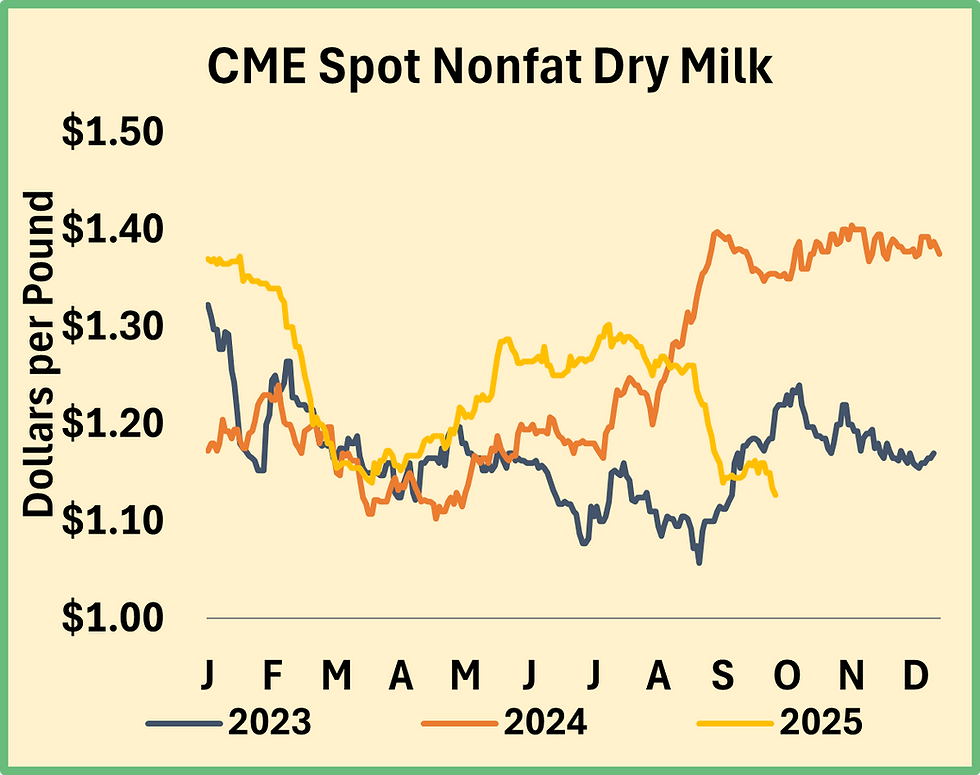

On the other side of the Class IV complex, prices are also slipping. Milk powder markets have shown enormous stability in recent months trading in only a very narrow range. However, the spot market for nonfat dry milk (NDM) has succumbed to overall weakness in the dairy markets and spent this past week moving downward. Prices closed Friday’s session at $1.1275/lb., down 3.25¢ from last week and notching the lowest price seen since May 2024. Demand for milk powders is tepid from both domestic and international sources and balancing plants maintain relatively light schedules as milk is largely routed to other uses.

The exception to the bear market tendency continues to be whey. Whey demand, particularly for high value products like whey protein isolates and whey protein concentrates with 80% protein remains insatiable. Even record high prices have done little to dampen this demand or encourage reformulation. With the whey stream largely prioritizing production of these value-added products, the amount of raw whey available for dry whey production remains limited, keeping prices supported. The CME spot dry whey price ended the week at 63.5¢ per pound, up a half cent from last Friday with 12 trades completed, including 10 on Tuesday alone.

Grain Markets

As the dairy markets coped with a lack of data, so it was in the grain markets, which did not receive this week’s scheduled World Agricultural Supply and Demand Estimates report. Markets remained relatively stable, with heavy supplies expected that are keeping prices under pressure. DEC25 corn settled at $4.1825/bu. on Thursday while DEC25 soybean meal settled the same day at $276.90/ton. Low feed prices are going to be crucial for maintaining dairy producer profitability as milk prices follow dairy commodity prices downward.

Comments