Milk, Dairy and Grain Market Commentary

- Sep 26, 2025

- 4 min read

By Sarina Sharp, Daily Dairy Report

Milk & Dairy Markets

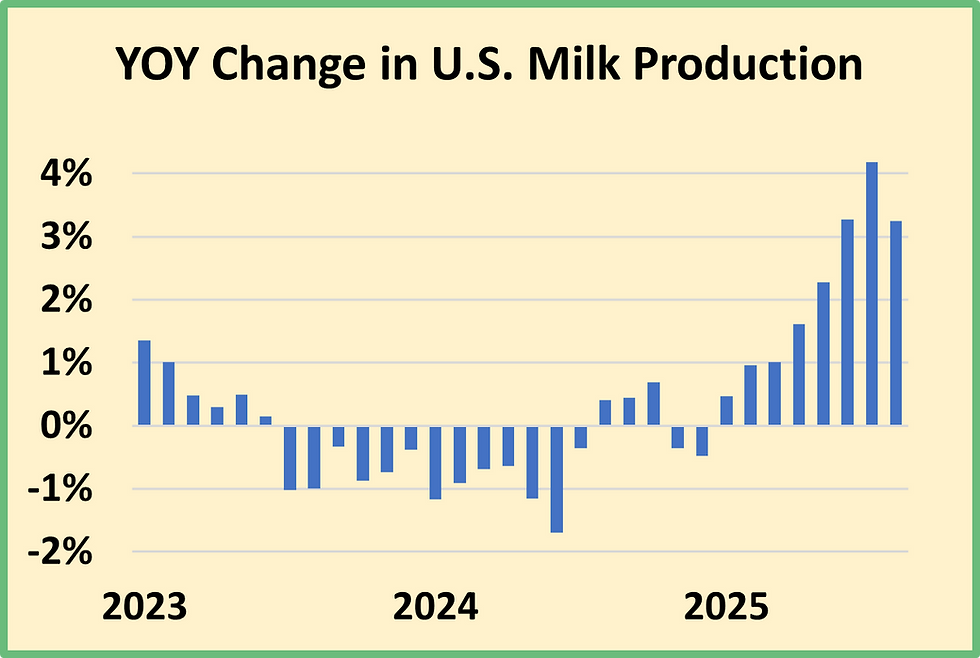

Milk is absolutely gushing out of the U.S. dairy industry. Milk production reached 19.52 billion pounds in August, up 3.2% from a year ago. USDA revised its estimate of July milk output and cow numbers upward significantly. The agency now reports that dairy producers added 35,000 cows in July and another 10,000 head in August. That put the August milk-cow herd at 9.52 million head, larger than at any time since late 1993 and up 176,000 head from a year ago.

Record-setting component levels continue to supercharge the growth in milk output. With 3.2% more milk, U.S. cows made 5% more butterfat, 4.2% more protein, and 3.6% more nonfat solids than they did in August 2024.

The dairy markets were blown away by the cow power highlighted in Monday’s Milk Production report. There’s plenty of butterfat for churns, and cheese vats are nearly full as well. The trade assumes that continued growth in milk production will head toward the nation’s milk powder plants, which have been running light for several years. Dairy product stocks are not burdensome yet, but they may become so if exports falter. And that’s becoming more likely as milk production climbs in Europe and New Zealand. U.S. dairy products will have to stay cheap enough to grow marketshare in an increasingly competitive international exchange.

China is the only major dairy market where production is in decline. But Chinese economic growth and consumer demand remain tepid. For now, the setback in China’s domestic milk and dairy product output is sufficient to stabilize imports at levels that are much lower than those that prevailed from 2017 to 2023. But Chinese demand is not strong enough to push most dairy product imports sharply higher. China’s year-to-date milk powder imports are up 1.4% from last year’s depressingly low volumes. In August, China brought in 32% less high-protein whey concentrates, 37% less butter, and 12% less cheese, emphasizing just how weak demand has become for more consumer-facing dairy products. But Chinese demand for whey powder remains strong. Chinese dry whey imports soared to a 30-month high in August, and, now that the U.S. and China have paused on tit-for-tat tariffs, the U.S. supplied more than half of the total.

Decent exports and low dry whey production have kept a firm bid in the whey market. Whey processors continue to direct as much whey as possible into high-protein concentrates and isolates. USDA’s Dairy Market News reports that “some manufacturers are sold out of dry whey for near-term shipment.” With that, CME spot whey powder climbed 0.75ȼ this week to 64.75ȼ per pound, the highest price in nearly eight months.

Milk powder prices also inched upward. CME spot nonfat dry milk (NDM) closed at $1.155 per pound, up 0.75ȼ this week. Despite a retreat in international milk powder values, it appears as though U.S. milk powder prices have fallen low enough to attract some buyers. Manufacturers in the West tell USDA’s Dairy Market News that demand is stronger and “Mexican buyers are more active.” But in the Central and East, “domestic demand remains soft and export interest is declining.”

Butter inventories declined at the typical seasonal rate from July to August. The drawdown implies that demand is strong enough to absorb unusually high butter output, at least during the off-season, when production is much lighter than spring output. There were just shy of 306 million pounds of butter in refrigerated warehouses at the end of August, 5.7% less than the year before. Nonetheless, the trade remains anxious that butterfat supplies will soon overwhelm demand. And falling European butter prices emboldened the bears. CME spot butter spent a few days in the $1.60s but closed at $1.72 per pound, down another 3ȼ this week.

Cheese inventories also declined slightly from July to August, but they typically drop by larger volumes in the heat of the summer. There were 1.42 billion pounds of cheese in cold storage at the end of last month, 0.9% more than in August 2024. Inventories of American-style cheeses, including the Cheddar that helps to set the Class III price, topped year-ago volumes by 2.1%. The data imply that cheese production is outpacing demand, even in the face of record-shattering exports. It’s no surprise to see the cheese markets in retreat. CME spot Cheddar fell 2.5ȼ this week to $1.625.

Red ink in the cheese and butter markets and anxiety about U.S. milk production growth weighed heavily on milk futures once again. The October Class III contract slumped 38ȼ to $16.80 per cwt., with similar losses and prices into early 2026. October Class IV futures plummeted 60ȼ to $14.75. When October milk checks arrive in about six weeks, dairy producers who are exposed to the Class IV markets are sure to be disappointed.

Grain Markets

The feed markets took a step back this week, buffeted by international headwinds. While trade talks between American and Chinese leaders ended amicably, they did not produce any new agricultural sales or even vague promises of future purchases. Meanwhile, Argentina temporarily rescinded its steep crop export tariffs, hoping that a rush of sales would bring foreign currencies to Buenos Aires and prop up the struggling peso. In just three days, Argentina sold $7 billion in agricultural goods, as many customers, including China, rushed to stock up while they were on sale. U.S. soybean exports are weak, and likely to remain that way in the near term. Corn exports are strong, but there is plenty to go around thanks to this year’s record-shattering crop. December corn futures fell 3ȼ to $4.21 per bushel. December soybean meal dropped $9 to $274.90 per ton. Dairy producers may soon cash some small milk checks, but at least their feed expenses will be low. And beef revenues will supplement on-farm margins like never before.

Comments