Milk, Dairy and Grain Market Commentary

- Monica Ganley

- Jul 12, 2025

- 4 min read

By Monica Ganley, Quarterra

Milk, Dairy & Grain Markets

Trade topics continue to dominate the headlines as the 90-day pause on the ‘Liberation Day’ tariffs came and went this week. While the situation remains fluid, the administration appears to have extended the overall reciprocal tariff pause until August 1, while sending a series of letters to specific countries threatening elevated tariff rates. Many of the countries that received tariff letters are key destinations for U.S. dairy exports, casting further doubt over U.S. dairy trade prospects in the coming months.

In the meantime, U.S. dairy trade data for May was released, showing mixed performance. U.S. dairy exports to China plummeted during the month, reflecting the intensifying trade conflict between the two countries. Low protein whey products were the most affected as the dramatic drop in Chinese demand caused year over year U.S. exports of dry whey, modified whey, and whey protein concentrates with protein levels under 80% to fall by 19.9%, 16.5%, and 35.6%, respectively. The industry is hopeful that recent agreements between the U.S. and China could help to buoy trade activity, though the relationship remains precarious

Outside of the whey complex, however, May’s trade data was decidedly rosier. In particular, cheese exports had another stellar month, zooming to an all-time high of 113.6 million pounds. While cheese shipments to Mexico fell 12% against last year’s record large figure, an uptick in exports to Japan, South Korea, and other destinations in Latin America boosted the overall figure. Butterfat exports also had another banner month as competitive prices kept U.S. milkfat moving offshore. Butter exports were up 129.7% year over year while shipments of anhydrous milkfat more than tripled versus May 2024. Even nonfat dry milk (NDM) eked out a 1.7% gain on an uptick in exports to Mexico, Central America, and select countries in Southeast Asia.

Exports have proven essential for clearing product and providing a floor to markets, especially for cheese. Even as total cheese production rose 3.3% in May, including a 9.6% increase in Cheddar production, the spot Cheddar price rose steadily through the month. But buyers appeared to balk at Cheddar blocks priced above $1.90/lb. causing prices to descend during most of June. So far in July, price moment at the CME has been choppy with prices persisting in the high $1.60s as the market seeks direction. Early gains in the spot block Cheddar price this week were canceled out by losses on Thursday and Friday which brought the price to $1.66/lb. at the close of Friday’s session, down 2.5¢ compared to prior week. A total of 42 loads of blocks traded hands, half of which traded on Thursday alone. Barrels were down 4.5¢ to $1.675/lb. as nine loads moved.

With cheese production on the rise, whey availability has also increased. Production of whey protein isolates continued to surge in May with volumes rising 9.5% year over year. However, whey protein concentrate production slipped 6.6% in favor of dry whey production, which was up 10.1% for the month. Additional dry whey availability may have put additional pressure on the spot price this week, which gave up 4¢ to end the week at 56.75¢ per pound with ten loads moving. Market participants report that domestic demand for dry whey has been healthy but future market performance hinges on developments in the trade policy arena.

Even as milk production begins to tighten seasonally, cream remains readily available. Upbeat churning activity translated to a 3.5% increase in butter production, according to the most recent Dairy Products report. Butter production for the month was especially pronounced in the Central region where volumes grew 7.6% year over year. The hefty price advantage that U.S. milkfat holds in the global market has kept product moving offshore, preventing inventories from accumulating and prices from deteriorating. The spot price took only a modest step downward this week, giving up 1.5¢ to end the week at $2.59/lb. as 17 loads moved.

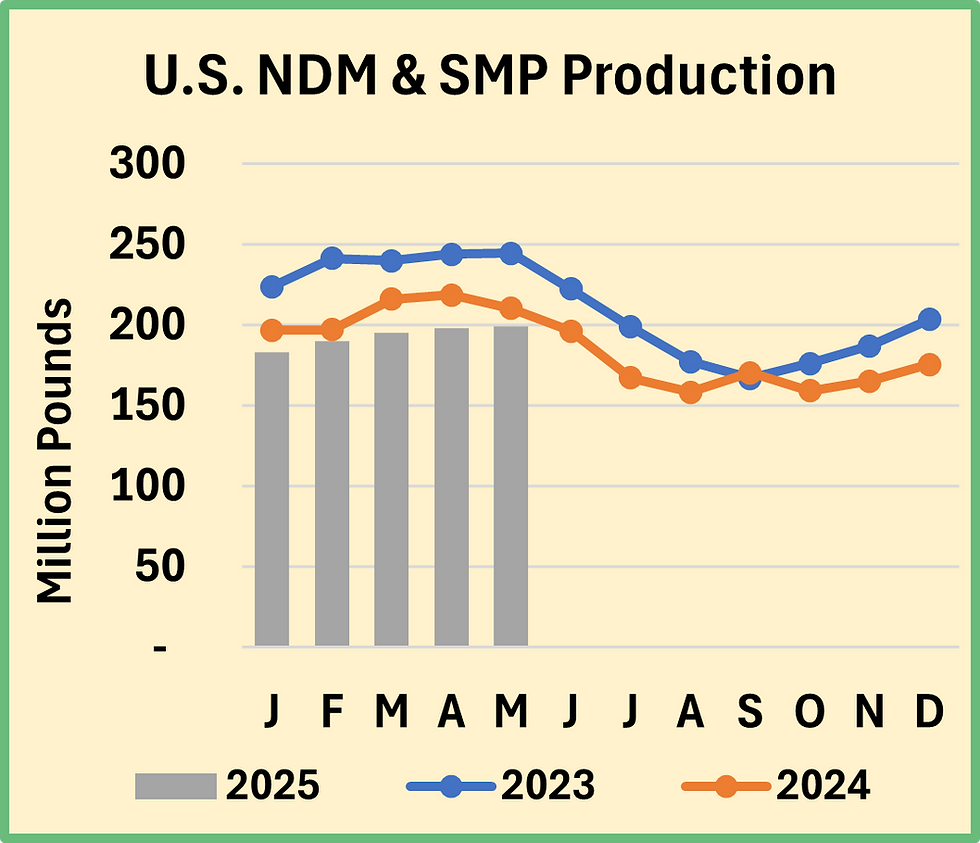

Of the spot markets, NDM was the only one to post a gain this week, adding three quarters of a cent to finish Friday’s session at $1.2675/lb. Milk powder production continues to lag prior year levels. In May, combined production of NDM and skim milk powder (SMP) totaled just 206.1 million pounds, a decline of 5.2% compared to the same month last year. Weak production is indicative of rerouting of skim solids towards alternative products as well as overall weak international demand. But the uptick in May milk powder export sales, however modest, may be a sign that the winds are shifting for global milk powder trade.

Anecdotal reports suggest that hot summer temperatures may be weighing on cow comfort and in turn, milk production. With most institutions on summer holidays, bottler demand remains light. Values for spot milk for manufacturing took a big jump this week but market participants suggest that may have more to do with tightness following the fourth of July holiday, rather than an indication of a shift in market fundamentals.

Grain Markets

Feed prices remain affordable and continue to support dairy producer margins. In today’s World Agricultural Supply and Demand Estimates (WASDE) report, USDA downgraded its estimate of corn production during the 2025/26 crop year by 115 million bu. to 15.705 billion bu. Despite the decrease, and a projected decline in ending stocks, USDA left its average farm price unchanged at $4.20/bu. On the soybean ledger, USDA shaved 5 million bu. off production, dropping the 2025/26 estimate to 4.335 billion bu. Even with the decline, the agency expects an increase in crushing and reduced its forecast of the average soybean meal price by $20 to $290/st. The grain and oilseed futures markets moved down modestly on the WASDE results.

Comments