Milk, Dairy and Grain Market Commentary

- Sep 20, 2024

- 4 min read

By Sarina Sharp, Daily Dairy Report

Milk, Dairy & Grain Markets

U.S. milk output fell short of year-ago volumes for the 14th straight month in August. The deficit was narrow; production was just 0.1% lower than August 2023. Given sizable improvements in milk components, butterfat and protein output were surely higher than last year, and it’s possible that milk solids output also topped August 2023 volumes. But August 2023 set a very low bar, and, at least on a fluid basis, U.S. milk output failed to clear it.

Dairy producers sent 43,900 fewer cows to slaughter than they did in August 2023. That was enough to hold milk-cow head counts steady from July to August at 9.325 million cows. There were 40,000 fewer cows setting hoof in a U.S. milk parlor than there were a year ago.

But 12 months of astoundingly low cull rates and six months of the bird flu have clearly taken a toll. The dairy herd is slowly becoming older and less efficient. Milk yields topped year-ago levels in August, but that’s because August 2023 was a scorcher in much of the South and West. A two-year comparison strips out some of the weather impact and makes clear the effect that the heifer shortage has had on dairy productivity. National average milk yields fell below the same month two years before in June, July, and August. That stands in sharp contrast to the typical two-year growth of around 2%. Dairy producers are trying to keep their barns full and make more milk, but waning milk yields are undermining those efforts. The prevalence of older milk cows with a lower genetic profile than their younger peers has also slowed gains in milk component levels.

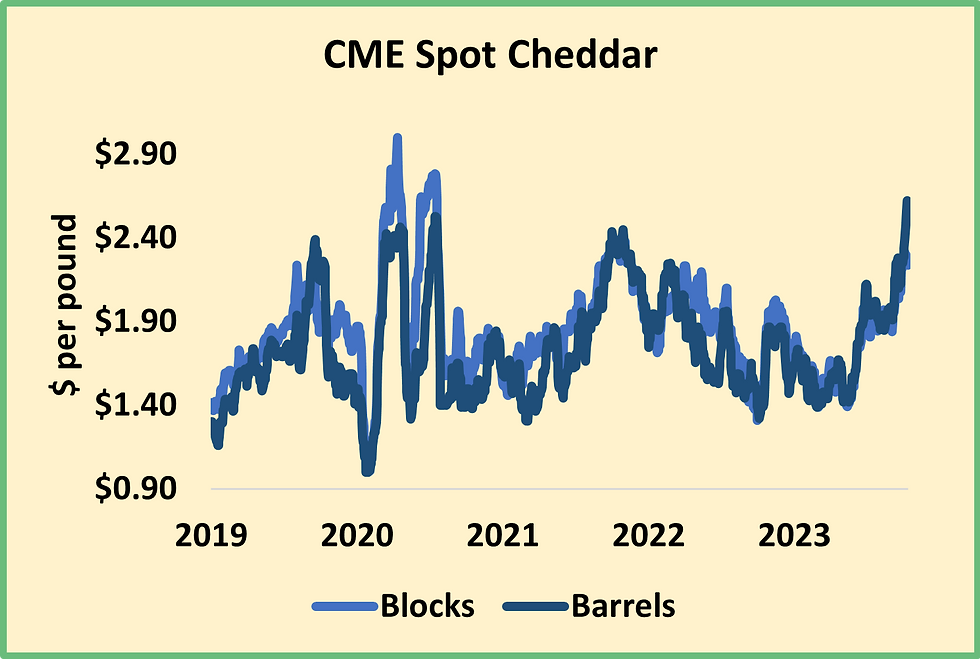

Tighter milk supplies have raised the premiums on spot milk. In years when spot milk is abundant and cheap, Cheddar barrel output typically climbs, because barrel manufacturing is one of the most efficient ways to push as much milk as possible through cheese plants. In years like this one, when spot milk is tight and expensive, barrel production often declines. Booming exports in the first half of the year also weighed on barrel output as several cheese processors tuned their vats to make Mozzarella, which many importers favor, rather than making Cheddar barrels. Through July, U.S. Cheddar production has slumped 7.2% from year-ago volumes. That’s created a clear shortage. CME spot Cheddar barrels touched an all-time high on Wednesday at $2.6225 per pound. That pushed barrels to their widest-ever premium over blocks, trading 37.75ȼ above the spot Cheddar block price on the same day. Barrels finished today a few cents off the high at $2.59, still up 10.5ȼ for the week. Meanwhile, blocks fell 3.75ȼ to $2.2375.

The other dairy products also retreated. Spot whey powder dropped 1.75ȼ to 58.75ȼ. Despite gains in milk powder prices at Tuesday’s Global Dairy Trade auction, CME spot nonfat dry milk (NDM) slipped 1.25ȼ. And butter took a big step back, falling 15.75ȼ to $2.9725, marking spot butter’s first foray below $3 since May. Butter makers spent all spring and summer making sure they had enough on hand to get through the holiday baking season, hoping to avoid a painful spike in prices like those they suffered in 2022 and 2023. This week’s steep selloff suggests they may have succeeded. We’ll know for sure in a few weeks.

The dairy markets remain well supported by some very strong fundamentals. The heifer shortage, avian influenza, and bluetongue disease will continue to restrain growth in milk output and tighten dairy product supplies. But there is a limit to how far prices can climb without throttling demand, and the trade seems to have bumped into the ceiling for now. A few Class III contracts gained ground this week, but the October through March contracts finished in the red. October Class III settled at $23.90 per cwt., down 12ȼ from last Friday and 56ȼ lower than the life-of-contract high it set just this morning. Most Class IV futures contracts posted double-digit losses. The October contract descended 46ȼ to $22.31. While they’re not as high as last week, these are still prices that will put a smile on dairy producers’ faces and add some cash to their bank accounts.

Grain Markets

Feed prices fell back this week. Farmers are starting to combine their corn and soybeans, and early results confirm that this will be a big harvest. But prices have already fallen low enough to win new export sales and boost domestic demand from livestock feeders, ethanol distillers, and soy crushers. Concerns about a dry start to the South American crop year and the decline in the U.S. dollar index have also lifted export prospects. As it seeks a balance between big crops and rising demand, the market will likely continue to bounce around in its recent trading range. December corn futures settled today at $4.015 per bushel, down 12.25ȼ from last Friday. November soybean closed at $10.135, up 7ȼ. December soybean meal closed at $320.20 per ton, down a couple bucks on the week.

Comments