Milk, Dairy and Grain Market Commentary

- May 26, 2023

- 4 min read

By Sarina Sharp, Daily Dairy Report

Milk, Dairy & Grain Markets

The Class III markets have tumbled for nearly six months. But there are signs that they have finally reached the valley floor. CME spot whey powder touched a record low on Monday, trading below 26ȼ for the first time in its five-year tenure at the spot market. But it perked up from there, finishing today at 27.5ȼ. That’s still cheap, but it’s a penny higher than last Friday. Traders tell USDA’s Dairy Market News that whey sold in Chicago is moving abroad. Chinese trade data confirmed healthy demand for whey powder. Although Chinese whey imports fell short of the record-setting volumes of 2021, they exceeded last year’s healthy volumes by 44% in the first four months of the year. The U.S. supplied nearly half of China’s whey purchases. Closer to home, demand has been soft, as there are plenty of inexpensive dairy proteins and carbohydrates, and buyers with flexibility are switching back and forth between lactose and permeates, reducing demand for commodity whey. However, “prices are at a point that some say they cannot ignore,” according to Dairy Market News. There is a lot of whey to be had, but at least the market has found a price that will keep it moving.

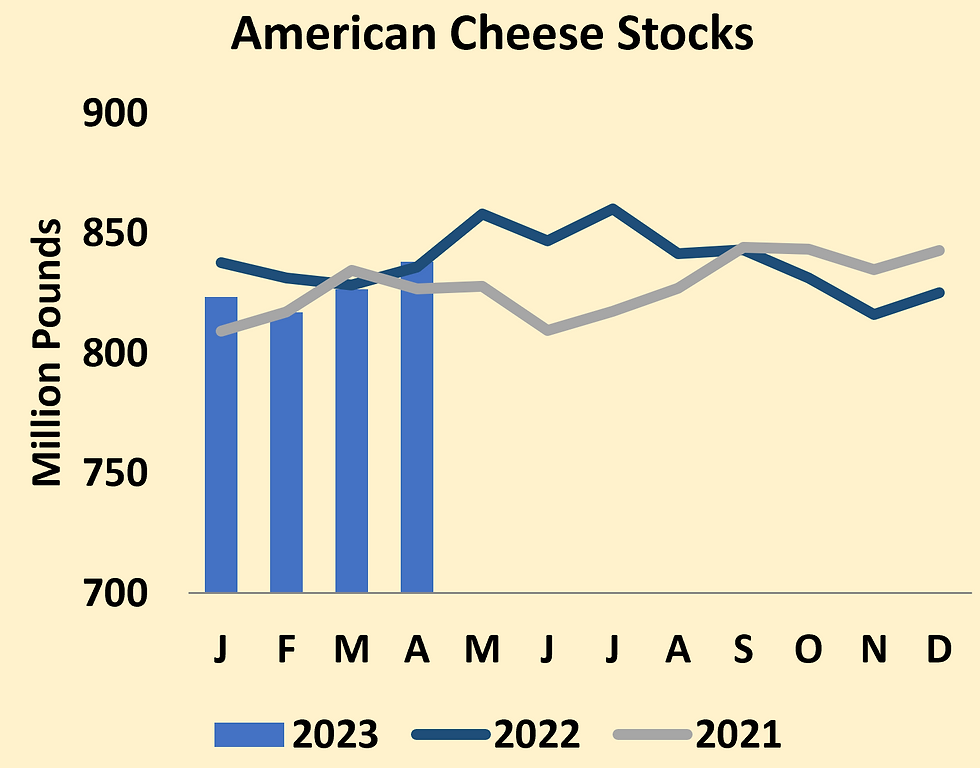

USDA created some fireworks in the cheese market this week, but the excitement quickly fizzled. The agency announced it would solicit bids for up to 47.6 million pounds of cheese to donate to food banks. But it has not yet specified when it would purchase this cheese, which made it difficult for the market to price in the impact, and a selloff at the spot market on Wednesday doused the bulls’ initial enthusiasm. Spot cheese values sunk further on Thursday, on the heels of the Cold Storage report, quelling hopes that the new data might have offered a little support to the beleaguered cheese market. USDA reported that cheese stocks grew just 3 million pounds in April, an unusually light stock build for the spring. Total cheese stocks were 1.2% smaller than they were a year ago. However, inventories of American-style cheeses – including the fresh Cheddar that trades in Chicago – grew from March to April and topped prior-year volumes by 0.3%, representing the first year-over-year increase in American cheese supplies in six months. CME spot Cheddar blocks plummeted 5.75ȼ to $1.4775, stopping just above a two-year low. But barrels climbed 2ȼ to $1.49. Lower prices are reportedly enticing some customers who had reduced their orders to pick up the pace, which could slow the flow of cheese to Chicago. However, production has likely accelerated as well. Several cheesemakers that were down for maintenance are back to full strength.

Cheap spot cheese and whey continued to drag down nearby Class III prices. June Class III logged a life-of-contract low today and settled at $15.88 per cwt., down 18ȼ for the week. The July and August contracts posted modest losses. But September through December rebounded, and November Class III finished at a more palatable $19.

The Class IV products continue to trade within their well-trod range, and Class IV futures held steady at around $18 nearby and $19 down the board. CME spot butter slipped 3ȼ this week to $2.43. USDA had initially reported a puzzlingly low estimate of March butter inventories, but it revised that figure upward in this week’s Cold Storage report. The agency also reported a seasonal increase in butter stocks in April. At the end of last month, there were 327.7 million pounds of butter in U.S. warehouses, 9.8% more than last year but considerably less than in 2021.

Spot nonfat dry milk (NDM) rallied 1.75ȼ to $1.17. The heat has helped to knock back milk production just a bit, but there is still plenty to go around, especially as bottlers face slower orders during summer vacation. Driers are running hard, and skim milk is widely available. Mexico continues to buy NDM at a steady clip, but the U.S. faces stiff competition in other markets. Europe has an abundance of skim milk powder (SMP), and so does New Zealand. After a poor start to the season, Kiwi milk collections have topped the prior year in every month since December, including a very strong showing in April. And, thanks to slower demand for whole milk powder (WMP) from China, New Zealand will be turning more of that milk into SMP and dumping the excess cream onto the global market in the form of cheap anhydrous milkfat. Through April, China bought SMP at an impressive pace. But Chinese imports of WMP continued to lag. Last month they fell 32% below April 2022.

Grain Markets

Rain in the Southern Plains is slowly helping to relieve the severe drought there. It’s too late to save much of the winter wheat crop, but the showers will help to replenish stock ponds, improve pasture conditions, and restore soil moisture for recent seedings. In the rest of the Farm Belt, the forecast is warm and dry. The trade has stopped worrying about the planting pace and started worrying about thirsty crops. That pushed July corn futures back over $6 for the first time in a month. They settled at $6.04 per bushel, up 49.5ȼ in a single week. Soybeans also finished sharply higher, with the July contract at $13.3725, 30ȼ higher than last Friday. July soybean meal closed at $402.20 per ton, down another $6.90.

Comments