Milk, Dairy and Grain Market Commentary

- May 12, 2023

- 4 min read

By Sarina Sharp, Daily Dairy Report

Milk, Dairy & Grain Markets

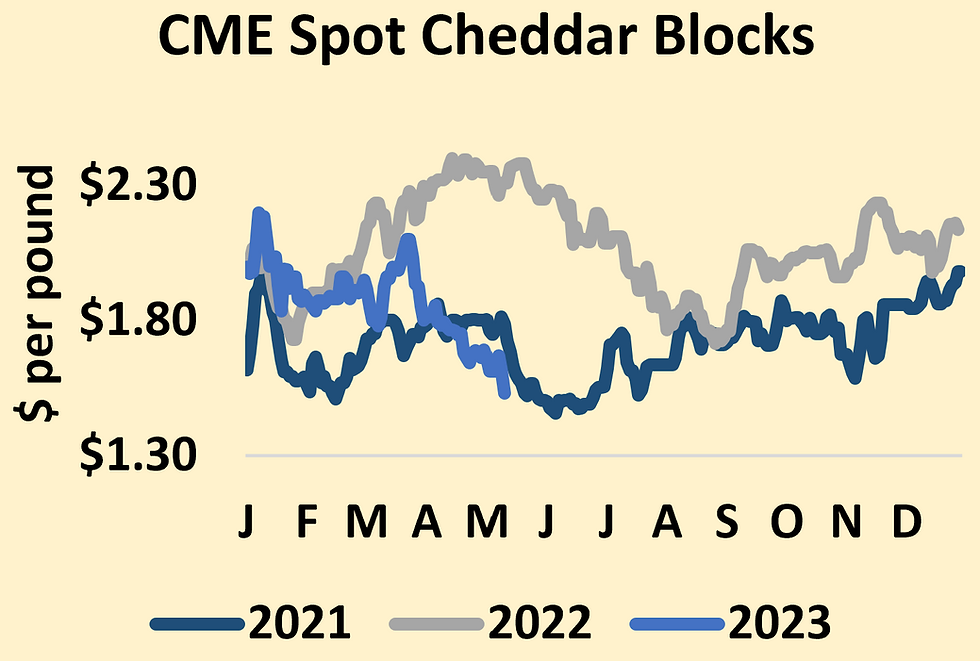

The bears prowled LaSalle Street this week, and the bulls were nowhere to be found. Spot dairy product values slumped, and milk futures followed them lower. The cheese market led the way downward. CME spot Cheddar blocks plummeted 8.25ȼ to $1.53 per pound, their lowest mark in nearly two years. Barrels dropped back to $1.49, down 4ȼ this week. These are prices that should attract some opportunistic importers, but USDA’s Dairy Market News reports that export sales are “softening.” Meanwhile, domestic demand is steady, which is not enough to keep inventories in check amid seasonally heavy output.

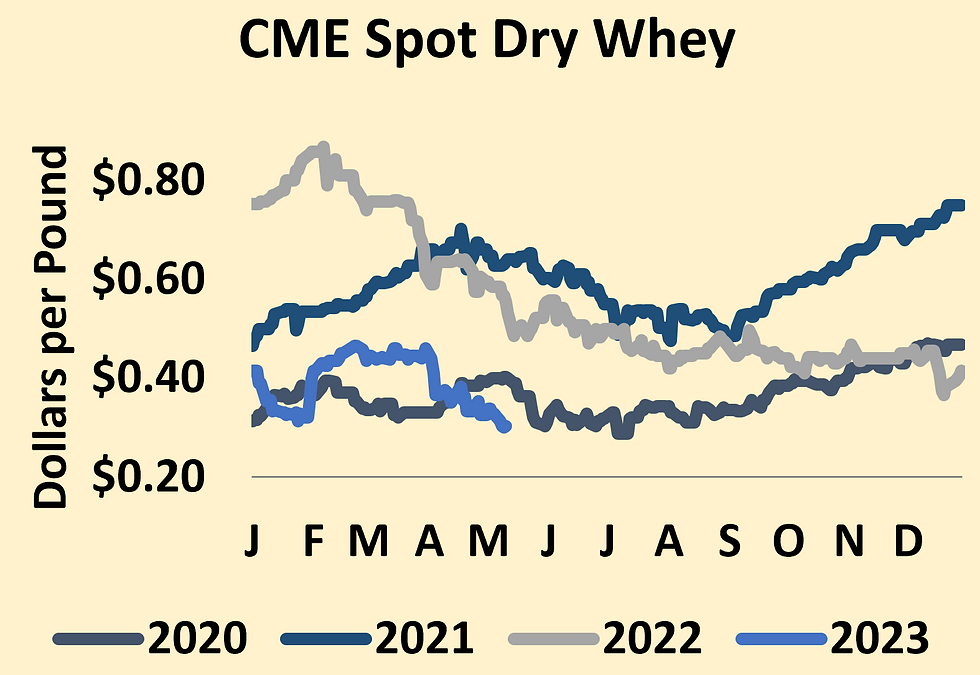

Whey prices also plumbed multi-year lows. CME spot whey powder touched 30ȼ for the first time since the summer of 2020, when nearly every gym in America was closed and protein shakes sat on the shelves. Spot whey closed today at 30.25ȼ, down 2.5ȼ for the week and 16.25ȼ lower than the recent peak set in February. Every penny decline in the whey price takes 6ȼ from Class III milk, so the spring setback has cut roughly a dollar from dairy producers’ projected Class III revenue. According to the Daily Dairy Report, “International demand has remained elevated, but short of exceptional, compared to historical standards. Dry whey exports were up year over year through March but have likely softened in recent weeks.” Deteriorating profitability in China’s hog sector may have slowed the flow of whey products to Southeast Asia, leaving more product in U.S. warehouses. But low prices may soon cure themselves, as U.S. whey is now extremely competitive. Even as U.S. values fade, benchmark European prices are starting to perk up.

Butter prices took a step back as well. CME spot butter lost 4.5ȼ and closed at $2.40. Cream supplies are starting to tighten as ice cream manufacturers ramp up production. But there is still plenty left over for churns, at least for now.

The milk powder market remains rangebound. This week it retreated 2.75ȼ to $1.17. Whenever prices drop toward the $1.12, buyers are quick to appear, but they back away from the market as values approach the $1.20 mark.

As befits the season, driers are running hard. In addition to clearing all the excess milk that comes with the spring flush, driers have been forced to pick up the slack from other processors who continue to run below peak efficiency. Once again this week, USDA cataloged complaints about mechanical issues, labor shortages, and freight delays. All of these problems push more milk to balancing plants, and the summer slowdown in milk bottling will soon add to the excess.

Spot milk continues to sell at steep discounts. This week, processors in the Upper Midwest bought milk at prices ranging from $4 to $12 below class, and even these deductions were not enough to find buyers for every load. As the Daily Dairy Report notes, “Based on today’s futures, dairy producers who ship to an oversupplied cooperative will be paid $16.25/cwt. for their share of contracted volumes sold to a Class III plant, between $4.25 and $12.25 for spot milk, and $0 for dumped milk. For many producers, the May mailbox milk price will be well below today’s futures.”

Even before those discounts, Class III futures are unpalatably low. The June contract dropped 42ȼ this week to $16.57. Deferred contracts also posted double-digit losses, but August through December futures are still well north of $18. Class IV milk also lost ground, but it started at a higher elevation. June Class III settled at $18.21, and fourth-quarter futures are holding above $19.

The bright side – if you can call it that – is that lower prices today will speed the transition to slower milk production and higher prices. The market is doing its awful work, pushing dairy producers to cull harder or sell out altogether. Unless we see a decisive uptick in foreign demand for dairy, we’ll have to suffer through months of low prices to cure these low prices.

Grain Markets

Fortunately, dairy producers will see some modest relief in feed costs, thanks to massive crops in Brazil. In today’s monthly update to USDA’s World Agricultural Supply and Demand Estimates, the agency raised its assessment of Brazil’s corn crop to an all-time high of 130 million metric tons, up 5 million metric tons (~182 million bushels) from their April estimate. Brazil simply cannot handle gargantuan corn and soybean crops all at once, and they are moving cargoes out the door as quickly as possible. Cheap Brazilian soybeans and corn are undercutting U.S. exports, which will result in higher end-of-season stocks. USDA also anticipates record-breaking corn and soy yields in the U.S. this year, as long as the weather cooperates.

Outside of the parched Southern Plains, the season is off to a good start, with a pleasant mix of showers and sunshine to boost soil moisture and allow for planting progress. Optimism about the nascent crop pushed December corn futures down near $5 per bushel. But supplies of corn ready to be consumed today are much tighter. July corn futures closed at $5.8625 per bushel, about a dime lower than last Friday but still at a price that suggests some scarcity. July soybeans plunged 46.5ȼ to $13.90, their lowest close since October. Nearby soybean meal regained some ground and finished at $432.90 per ton, up $6.80 for the week.

Comments