Milk, Dairy and Grain Market Commentary

- Nov 22, 2024

- 4 min read

By Sarina Sharp, Daily Dairy Report

Milk, Dairy & Grain Markets

Never doubt the power of the profit motive in a free market. In the face of a devastating virus and a systemic heifer shortage, American dairy producers nevertheless found a way to add cows and boost milk production. In fact, they expanded the herd and grew milk output at a faster clip than previously thought. USDA revised its estimate of September milk production upward. The agency now shows September milk output up 0.4% from the year before, on par with growth in August. And, according to the latest figures, dairy producers added 18,000 cows from August to September, up sharply from an initial estimate that showed no month-to-month change. The growth continued in October, with milk production up a modest 0.2% year over year and an additional 19,000 cows setting hoof in the milk parlor. That put the dairy herd at 9.365 million head, outpacing year-ago numbers for the first time since May 2023.

How did they do it? Over the past 12 months, dairy producers sent 380,000 fewer cows to slaughter than they did, on average, during the preceding five years. That was enough to push the milk-cow herd up 10,000 head from where it stood a year ago, a 0.1% increase. But growth in milk production remains slow as avian influenza and the older dairy herd continues to weigh on milk yields. Milk production per cow fell short of 2022 levels in June, July, and October. The dairy herd has made huge gains in butterfat output and modest advancements in protein production. But on a fluid milk basis, today’s cows have not improved on the performance of their peers from two years ago.

Milk output fell hard in the Golden State. The bird flu ravaged herds in the Central Valley, dragging California milk output down 3.8% from October 2023 levels. The illness continues to infect new herds in the nation’s most concentrated milk shed. But these losses were more than offset by huge gains in Texas (8.8%), South Dakota (+9.6%) and Kansas (+4.2%). The new Kansas cheese plant is now taking in milk and filling its vats. There are 8,000 more cows in the Sunflower State than there were a year ago. Over the same period dairies added 17,000 cows in South Dakota and 40,000 in Texas. They’re getting ready to fill significant expansions to cheese production capacity in those states. Producers who are signed up to supply the new cheese vats have had years to boost their head counts, and several major dairy producers adjusted their breeding programs, forgoing lucrative beef calf income to ensure they could populate their barns by this winter or next spring.

The industry is acutely aware that the additional milk is destined for cheese plants. USDA’s confirmation of higher milk output packed a huge punch in the cheese market. CME spot Cheddar fell 4.75ȼ to a fresh seven-month low at $1.645 per pound. Barrels fell 3.5ȼ to $1.65, also the lowest mark since April. It’s likely that these lower prices will attract at least some new demand, but the road to balanced supplies is likely to be a bumpy one.

Through October, U.S. milk output was down 0.5% compared to the first 10 months of 2023. But thanks to relentless gains in butterfat tests, U.S. milkfat output was up 1.9% over the same period. Here too, the data show evidence that low cull rates are not the ideal way to boost milk and component production. For milk sold within the Federal Milk Marketing Order, butterfat tests averaged 4.22% in October. That’s impressively high, to be sure. But it’s only 0.05 percentage points above October 2023, the narrowest year-over-year increase in the butterfat test in 19 months.

But slower growth is still growth. There is more than enough butterfat to go around. Holiday production of dips and whips is in full swing, and churns are running hard too. Robust butter output continues to weigh on the price. CME spot butter fell a dime this week to $2.53, matching its lowest price so far this year.

U.S. milk powder prices also took a step back on the heels of the Milk Production report. CME spot nonfat dry milk (NDM) dropped 3.25ȼ to a one-month low at $1.3675. USDA’s Dairy Market News suggests that cheap cheese is weighing on U.S. NDM export values. The agency notes, “Typically, ahead of the holiday lull, Mexican importers are active on the NDM markets to fulfill holiday and Q1 needs. However, this year, Mexican interests have not been noticeably robust. Some contacts suggest bearish U.S. cheese market prices have given Mexican end users less incentive to add to NDM supplies, which would go into cheese fortification south of the border.” Mexican importers may help the U.S. dairy industry to strike a balance between heavy cheese output and lower milk powder production, as they adjust their purchases accordingly.

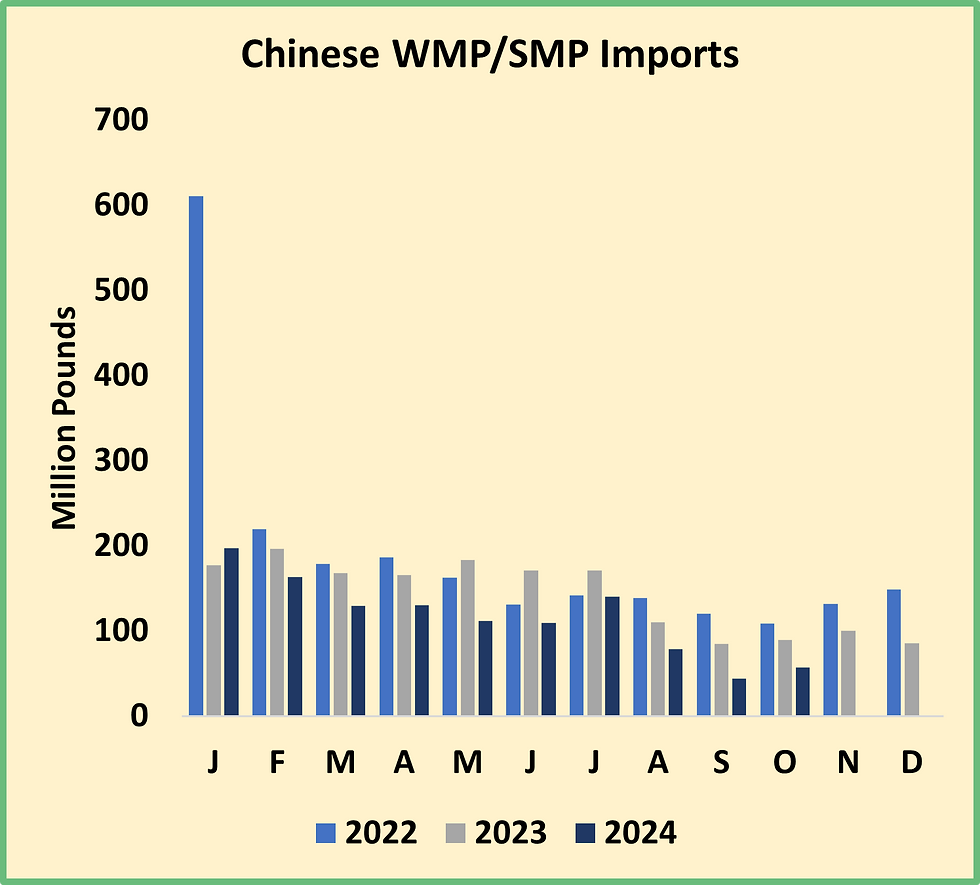

China imported very little milk powder in October, with volumes only slightly better than the multi-year lows set in September. The poor showing caught the trade by surprise, as China has been an active buyer at the Global Dairy Trade (GDT) auction this fall. At this week’s auction, decent demand from China pushed GDT milk powder prices to nearly two-year highs.

Once again, the whey market bucked the trend. Insatiable demand for high-protein whey products continues to limit drying. Meanwhile, Chinese whey product imports topped year-ago volumes for the fourth time in five months. The outlook is positive, unless U.S. whey shipments become a casualty of the looming U.S.-China trade war. CME spot whey powder added another half-cent this week and reached 66ȼ, the highest price since March 2022.

That wasn’t enough to stop the bleeding in the Class III markets. December Class III fell 31ȼ to $18.45 per cwt. The January contract dropped 66ȼ this week. The red ink abated in deferred contracts, but most Class III futures are now sitting well below the $19 mark. December through March Class IV futures also took a big step back. Most contracts stand between $20 and $21.

Grain Markets

The feed markets didn’t move much. March corn finished close to where it began the week at $4.355 per bushel. January soybean meal held steady at $292.30 per ton.

Comments