Milk, Dairy and Grain Market Commentary

- Mar 8, 2024

- 4 min read

By Sarina Sharp, Daily Dairy Report

Milk, Dairy & Grain Markets

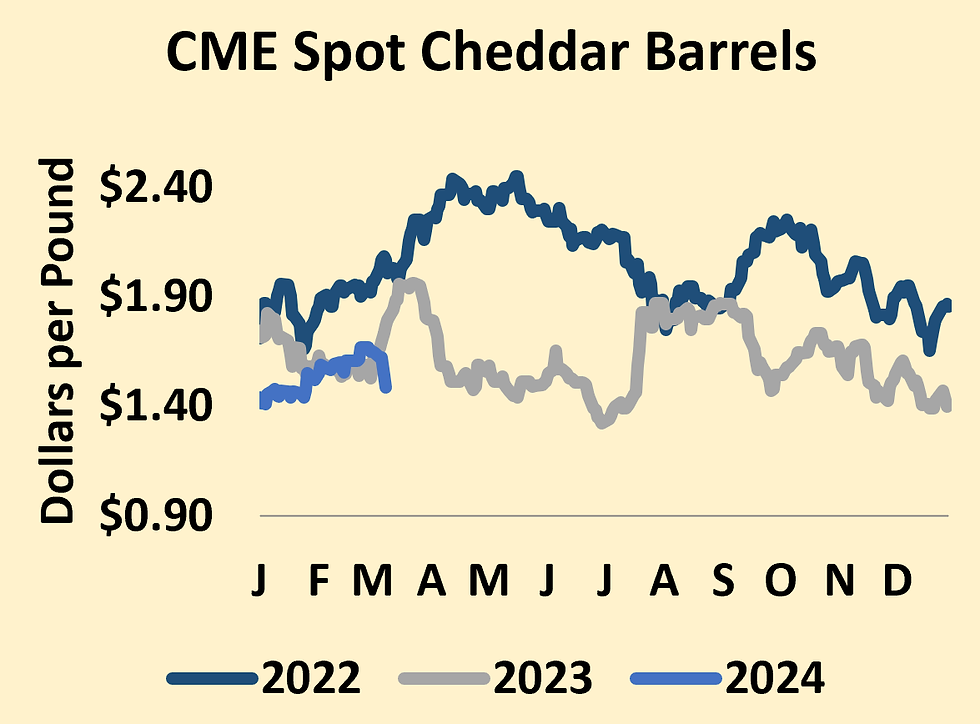

The dairy markets are feeling around for a bottom. April through July Class III futures notched life-of-contract lows this week. But the bulls are not wallowing in despair. These are prices that will continue to spur contraction in the industry, reducing milk production and dairy product output. Indeed, despite massive investments in U.S. cheese production capacity, cheese output fell 1.2% below prior-year volumes in January. Cheddar production, an important factor for the price in Chicago, fell 7.9% year over year in January. And inexpensive U.S. cheese attracted foreign buyers. Exporters sent nearly 85 million pounds of cheese abroad in January, the highest January total on record and 12.9% more than in the first month of 2023. That was not enough to prevent additional declines in spot cheese prices. CME spot Cheddar blocks fell 9ȼ this week to $1.46 per pound. Barrels plummeted 16.25ȼ to $1.4875. Class III futures followed cheese lower, but by Friday the trade was simply unwilling to retreat any further. Spot cheese dropped hard on Friday, but Class III futures shrugged it off and staged a small rally.

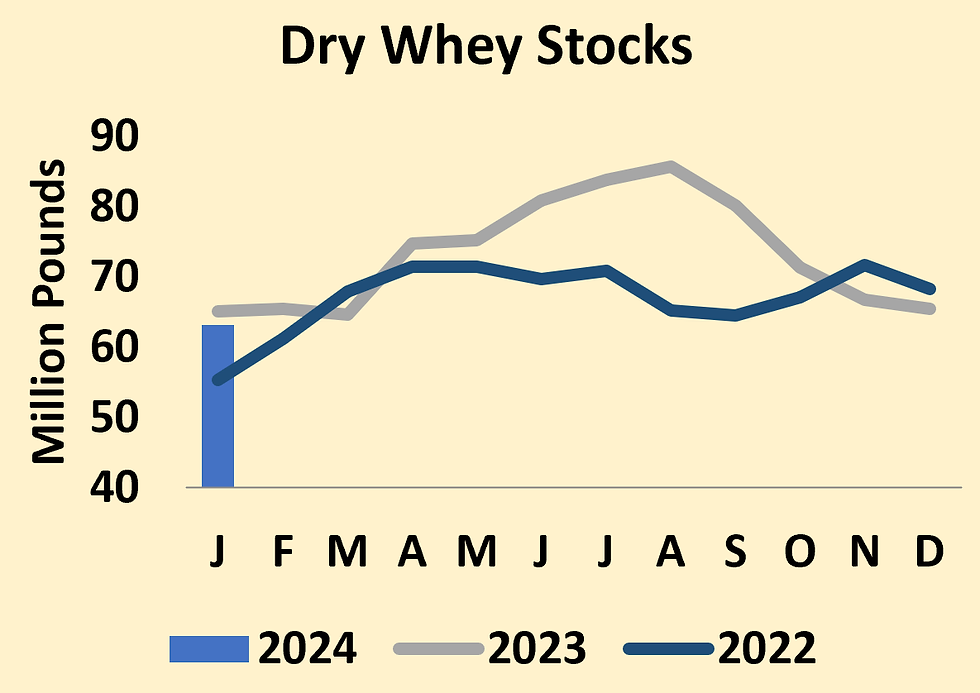

CME spot whey powder also lost some ground, slipping 1.5ȼ this week to 41ȼ. Processors continued to direct more of the whey stream to high-protein products in January, but there was enough left over to allow for a modest year-over-year increase in whey powder output. Stocks inched down slightly, and they stood well below the burdensome volumes that prevailed throughout most of 2022 and all of 2023. Nonetheless, whey prices are on the defensive as foreign demand remains tepid. U.S. whey powder exports were 2.9% greater than the modest volumes sent abroad in January 2023, but they look light in comparison to typical monthly volumes over the past few years. USDA’s Dairy Market News characterizes the whey market as “bearish to uncertain.”

U.S. milk powder output remains in the doldrums thanks to the milk production deficit. Combined production of nonfat dry milk (NDM) and skim milk powder (SMP) fell 6.6% in 2023. January NDM/SMP output was down 10.7% from the same month in 2023. And manufacturers stepped up SMP production to kick off the year, which signals optimism about export prospects in the months to come. But January exports did not impress. They fell 14% from year-ago volumes as the pace of Mexican imports slowed to a brisk jog after last year’s full-out sprint. The industry expects that lower milk production could translate to sharply higher milk powder prices. But for now, poor global demand is once again weighing on the market. SMP and whole milk powder prices turned south at the Global Dairy Trade auction, losing 5.2% and 2.8%, respectively. That was enough to drag CME spot NDM down 2.75ȼ this week to $1.17 per pound.

Once again, butter bucked the trend. CME spot butter rallied 4.5ȼ to $2.8025, toward the high end of the recent trading range. The relentless increase in butterfat in U.S. milk has produced more than enough cream to supply all the new cheese vats with plenty left over for Class II manufacturers and butter churns. In January, U.S. milk output fell 1.1%

from the prior year, but cream production leapt 1.7% as the average fat test in U.S. milk reached 4.35%. At the same time, production of protein and milk solids was steady or lower as those components did not climb enough to offset the decline in milk production. Relatively inexpensive cream allowed churns to run hard, and butter output jumped 6.4% from January 2023. Nonetheless, prices remain firm thanks to Americans’ formidable appetite for butter and dairy fats.

Although the markets recovered somewhat on Friday, milk futures finished the week lower than where they began it. April Class III traded in the $15s on Wednesday, Thursday, and Friday, at prices that are sure to depress dairy producers. It ultimately settled at $16.08 per cwt., down 67ȼ for the week. Across the board, Class III contracts lost 40ȼ on average. The trade hopes that Friday’s momentum will carry into next week, spurring a further recovery to more palatable milk prices.

Class IV futures also took a big step back, albeit from a much higher starting point. The April contract settled at $19.80, off 8ȼ. May through December Class IV lost an average of 27ȼ. The wide spread between Class III and IV milk will continue to prop up milk checks for the minority of U.S. dairy producers who benefit from Class IV depooling. But most producers will struggle with low Class III milk prices and steep discounts. Inadequate prices are likely to stick around until international demand perks up. But when it does, tight stocks and slow milk output could prompt a steep increase in dairy product prices, lifting dairy producers’ spirits and their incomes.

Grain Markets

After plumbing three-year lows, feed prices bounced back last week and kept climbing this week. May corn settled today at $4.3975, up 15ȼ since last Friday. May soybeans closed at $11.84, up 32.75ȼ. May soybean meal finished at $341.40 per ton, up $9.10. The funds have been holding a huge net short position, and they began to buy back some contracts last week in order to bank their profits. The fund trading was large enough to spur futures higher and prompt additional short-covering as corn and soybean prices busted through key points on the charts. Investors covered more shorts ahead of today’s USDA crop reports.

The agency made no changes to U.S. corn and soy balance sheets, and it trimmed South American soy production only slightly. The weaker dollar and a relatively dry forecast in central Brazil suggest that crop prices may have fallen far enough for now, but further upside is likely limited barring additional weather issues in Brazil in the near term or in the U.S. later this year. The world has plenty of grain, and feed costs are likely to move lower in the long run.

Comments