Milk, Dairy and Grain Market Commentary

- Feb 16, 2024

- 4 min read

By Monica Ganley, Quarterra

Milk, Dairy & Grain Markets

USDA released its 2022 Census of Agriculture earlier this week, providing the latest installment of the once-every-five-year report on the state of agriculture in the country. Unsurprisingly the report showed that farm numbers have fallen while expenses have risen, and the average American farmer has aged. But the report provided some encouraging information, as well. Total farm income rose by 39.8% compared to five years ago, while average farm income increased by 50.2%. Furthermore, agricultural producers have seen their most critical assets appreciate significantly with the value of land and buildings coming in at an average of $1.782 million dollars per farm, up 35.8% versus 2017.

On the dairy side of things, the report illustrated an industry that continued to consolidate. According to the census, there were 24,082 farms with off-farm milk sales in 2022, down 38.7% from 39,303 in 2017. Farms have gotten larger and per the census, an estimated 65% of U.S. dairy cows are now found on operations with more than 1,000 head. This is 10% more than in 2017. 834 farms had more than 2,500 head as of the 2022 census, an increase of 16.8% compared to the last count. In turn, fewer dairy cattle also live on smaller farms. According to the census, 6.5% of cows were found on operations with less than 100 head in 2022, down from 12.7% in 2017.

With spring around the corner, milk production is steady to modestly higher in most parts of the country. Winter weather conditions have been mild in recent weeks and are helping to support seasonal growth in milk volumes, especially in the West. However, numerous market stakeholders indicate that output is down compared to last year given the exits and reductions that producers have made over the last 12 months. In the Central region, Dairy Market News writes, ‘overall milk availability is much lighter than it was at this time in 2023. This week’s reported spot milk price range was Class III to $1 over. Last year, during week seven, spot milk prices ranged from $10 to $2 under Class. Bottler demand has been steady but with a short week ahead and spring vacations on the horizon, manufacturers are preparing to pick up the slack.

Lighter milk supplies have been felt by cheesemakers that have expressed their desire to increase processing to build inventories ahead of the spring holidays. A lack of spot milk supplies is being compounded by labor issues among some plants which have led to slower production schedules. Retail demand is mixed across the country as some regions report better performance than others. Meanwhile, foodservice demand is starting to show signs of life.

But if the market has begun to tighten up, the spot Cheddar block market refused to acknowledge it as prices eroded during the second half of the week. A brief 1.5¢ uptick on Monday was canceled out by losses on Wednesday, Thursday, and Friday. Blocks finished the week at $1.48/lb., down 9¢ from last Friday as 16 loads traded hands. Meanwhile barrels marched steadily upward, notching a new high for the year at $1.6075/lb. This is 3¢ higher than last Friday’s close while eight loads moved. This week’s dynamics in the cheese market have pulled the inverted block barrel spread to 12.75¢, the largest gap since June 2023.

After weeks of protagonist tendencies, the whey market was remarkably subdued over the last few days. The CME spot dry whey market sat unchanged for the first half of the week before adding a penny on Thursday and immediately wiping it away on Friday as the week’s only load changed hands. The end result was that the market finished Friday’s trade unchanged at 53¢ per pound. Slower than desired cheese production has reduced the whey stream and tightened up the whey market at the edges. Product remains available, and higher protein products continue to capture a meaningful share of the raw whey stream, but there is certainly some additional tension in the market.

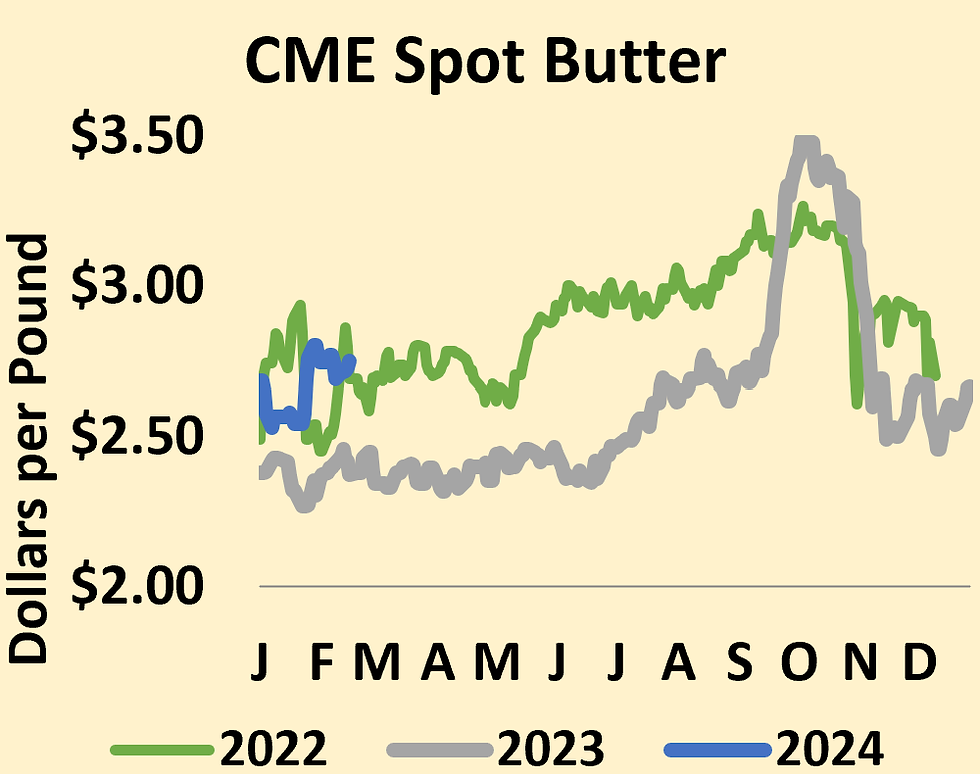

The Class IV markets moved in opposite directions this week as the butter market gained ground while nonfat dry milk (NDM) gave up terrain. Across the country, cream is available and butter churns are maintaining active schedules. Even so, inventories are not excessive, and demand remains upbeat. After retreating from the highs seen during the final days of January, the spot butter market found traction this week. Except for taking a breather on Tuesday, the market moved continuously upward during the other days and ended Friday’s session at $2.75/lb., up 6¢ from the prior week.

On the other hand, NDM markets skidded downward. After remaining unchanged on Monday, the spot market lost value every other day of the week with the price falling to $1.17/lb. when the dust settled. This represents a 3¢ decline compared to last Friday but keeps the NDM market soundly in the range that it has occupied in recent months. 16 loads of powder traded hands over the course of the week. Milk powder production is steady, but demand has been quiet, especially from key export customers in the Mexican market.

Grain Markets

The grain markets continued to move downward this week as agricultural economists and stakeholders gathered at USDA’s annual Outlook Forum. Plentiful supply expectations and healthy inventory levels pushed the grain markets further downward which will be welcome news for dairy producers seeking additional feed cost relief. On Friday, MAR23 corn settled at $4.165/bu., down 14¢ from Monday while MAR23 soybean meal took a more modest dip to $345.60/ton.

Comments